I have been getting this question often in recent months. Founders have a business idea, have tested it and are ready to start marketing and selling it. How much should they spend on marketing? What size marketing and sales budget should be included in their financial model?

Here is a general approach:

- First lets define marketing & sales for a startup. The marketing & sales budget should include ALL costs associated with acquiring and retaining customers and increasing revenue (or engagement) per customer. Big companies can worry about the difference between sales and marketing and related organizational complexities. For startups, it is all about acquiring and retaining initial customers.

- Now lets start at the end. What are your near-term sales goals? What sales or traction milestone do you need to achieve to hit the next phase of your startup? So, for the purpose of this example, lets say that you need to hit $50,000 monthly revenue in 12 months. And your average customer is worth $20 per month. So, you need to be at 2500 customers in 12 months.

- Next, do some research on your business/market to understand some basic parameters, such as:

- How long is the sales cycle, from beginning to first transaction?

- What are benchmarks for the cost of acquiring a customer in your market? There is a lot of public data available on this.

- What are the different buckets of marketing costs that you need to consider? At minimum:

- Lead generation – people, content marketing, SEO, ads, social, etc…

- Sales process (from lead to close), including commissions

- Retention/engagement, including customer service

- From there just do math to figure out the answer on the size of your initial marketing & sales budget.

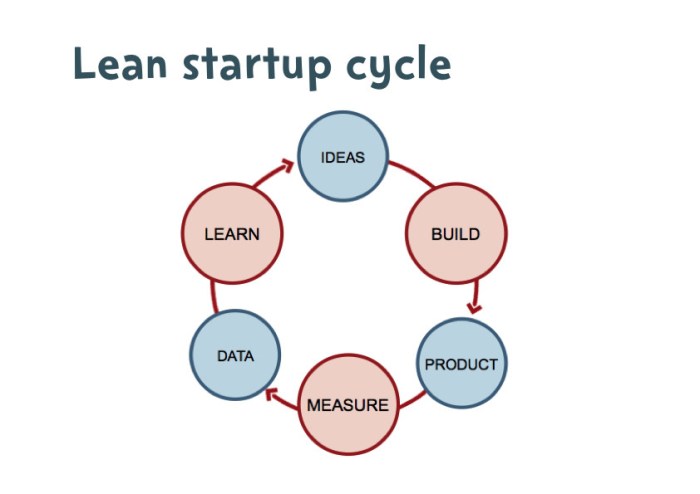

- Finally , this is the important part – measure the results and make adjustments based on actual data. Change the total budget. Change the mix. Figure out what works. If something is working, double down on it. Budgeting is a PROCESS.

OK, I know what you are probably thinking. Where do I get the magical data in Step 3?

Remember this is a PROCESS. Start with something then adjust. For many businesses here are rules of thumb to start with:

- Sales cycle of 6 months. Marketing dollars spent today will result in sales in 6 months.

- Monthly Marketing & Sales cost = 6 x Monthly revenue of net new customers. So, if you need to add 400 customers at $20 per month in revenue, a first cut budget should be 6 x (400 x $20) = $48,000 per month.

- Adjust to make sure this makes sense based the characteristic of your business. The lifetime value of the customer should be 3.5x the cost to acquire and retain that customer. In our example above, our cost of customer acquisition and retention is ($48,000/400) = $120. Let’s assume the lifetime value of a customer is $20 per month x 36 months x 50% margin = $360 per customer. So, $360 / $120 = 3.0x. That does not meet the target of 3.5x. So, you need to make an adjustment somewhere. For example, reduce initial marketing budget to $40,000 and start with than. That’s Ok. That is why this is a PROCESS.

So how do you breakdown the marketing dollars by programs? Here’s a starting point:

Year 1 – 80% lead gen/sales and 20% retention/engagement

Year 2 – 67% lead gen/sales and 33% retention/engagement

Year 3 – 50% lead gen/sales and 50% retention/engagement

If you have no other data, start with this and adjust. The lean startup mantra of Build – Measure – Learn is not just for developers. It’s for marketers too!

me, it has created more random clutter. Now, when people want to meet, I’m notified in both Slack and Mail. Is this one meeting, or two? Who knows? It will change three times and I will probably miss it anyway.

me, it has created more random clutter. Now, when people want to meet, I’m notified in both Slack and Mail. Is this one meeting, or two? Who knows? It will change three times and I will probably miss it anyway.

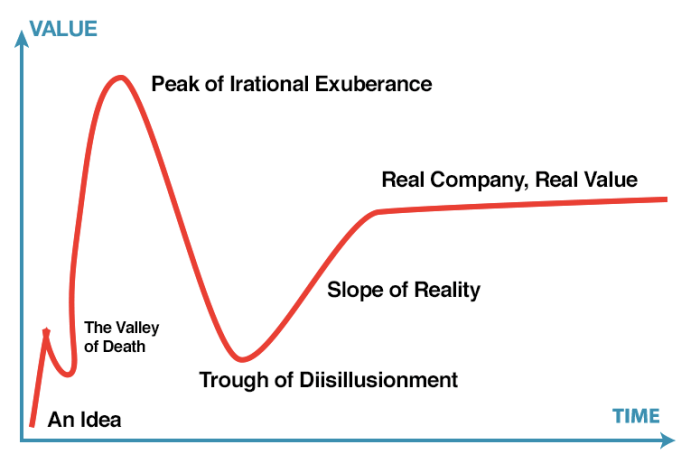

Following the dot-com bust 3 years later, VerticalNet was dismantled and parts were sold of for less than $10 million.

Following the dot-com bust 3 years later, VerticalNet was dismantled and parts were sold of for less than $10 million.